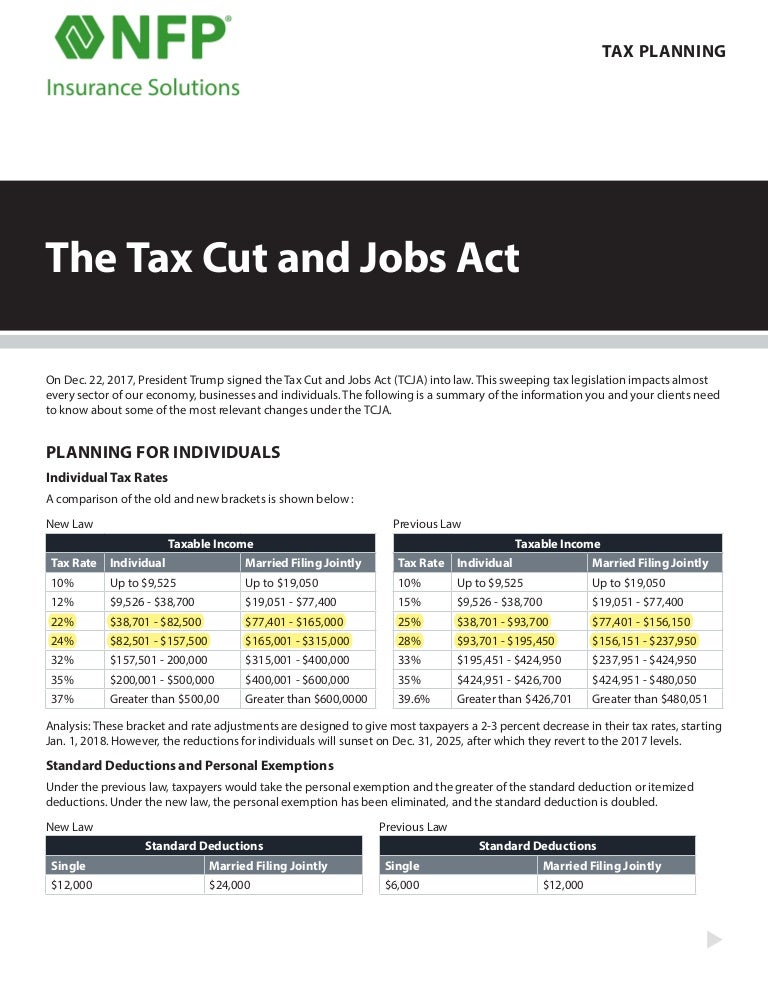

Tax Cut And Jobs Act Expiration 2025. Almost all these provisions expire after 2025. However, the 21% corporate tax rate, a permanent change, will remain intact.

However, the 21% corporate tax rate, a permanent change, will remain intact. Tax code, but the meandering voyage of its passing and.

Tax Cuts And Jobs Act 2025 Alfy Juditha, Corporate and personal income tax rates were reduced under the tax cuts and jobs act of 2018 during mr.

Tax Cuts And Jobs Act 2025 Alfy Juditha, While trump vowed to end the tax break during his first term, the tax cuts and jobs acts of 2017 enacted a smaller change — extending the required holding period for long.

Tax Cuts Jobs Act Expiration In Powerpoint And Google Slides Cpb PPT, While trump vowed to end the tax break during his first term, the tax cuts and jobs acts of 2017 enacted a smaller change — extending the required holding period for long.

Tax Cuts and Jobs Act, Key tax cuts and jobs act (tcja) of 2017 provisions are slated to expire on december 31, 2025.

Tax Cuts and Jobs Act YouTube, Key provisions at risk include individual tax cuts, the 20% qbi passthrough deduction and bonus depreciation—all of which will expire at the.

3 MustKnow Updates Prepare for Tax Cuts & Jobs Act Expiration YouTube, Learn how the 2017 tax cuts and jobs act expiration in 2025 will affect federal income tax rates, personal exemptions, and potential filing complexities.

The Tax Cuts & Jobs Act Is Scheduled To Sunset In 2025 Do You Have A, The tax cuts and jobs act made significant changes to individual income taxes and the estate tax.

Year End Tax Planning Is Made More By Expiration Of Tax Cuts And Jobs, While trump vowed to end the tax break during his first term, the tax cuts and jobs acts of 2017 enacted a smaller change — extending the required holding period for long.

Full Details and Analysis Tax Cuts and Jobs Act Tax Foundation, Tax brackets, income tax rates, child tax credit, state and local tax deductions, mortgage interest deductions and much more will literally change overnight.